How macroeconomics relates to financial accounting

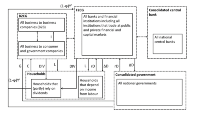

Imagine a closed economy with a Gross Domestic Product (Y) which equals C+G+I wherein all labour is either employed by privately owned companies (jointly referred to as B2CG) or privately-owned financial institutions (jointly referred to as F2CG). In this economy governments do not employ people, but they source all their services from the private sector instead (for simplicity purposes). Now assume a large global merger of all privately-owned companies (B2CG) and all banks and all other financial institutions in the economy (F2CG), which we will refer to as “the private sector”. This truly capitalistic closed economy is visualised below.

If we would obtain the consolidated financial statements of the private sector we would eliminate all business-to-business transactions and positions of the closed economy, because they would all qualify as intercompany transactions and positions. This leaves us with all business-to-consumer (C) and business-to-government (G) transactions in the economy. Therefore, these financial statements represent all transactions and positions between the private sector against all households and governments (jointly referred to as the “public sector”). These financial statements are drafted below (allowing a few non-critical simplifications).

In the financial statements, s is a constant fraction of Y that is activated (at historic costs) on the balance sheet such that corporate investments I equal sY, δ is the depreciation rate of all capital goods owned by the private sector relative to Y, τCIT is the corporate income tax rate relative to revenues (either Y or rD), α is the gross margin (added value) of the private sector relative to Y, r is the weighted average public interest rate and D is the public debt level (sum of household debt and government debt).