Financial instability

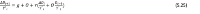

From the financial statements of a truly capitalistic closed economy we can derive the exact public budget constraint (formula 5.25), which expresses the public budget deficit of year i+1 (ΔDi+1) relative to the Net Domestic Product (Y’ ≡ Y-δY=C+G+sY-δY≈C+G if s≈δ).

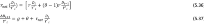

The right side of the exact public budget constraint shows the various components that are funded by the public debt increase. The first term reflects nominal growth (g). The second term reflects the saving rate (ϴ) of some households and part of the private sector which implies an equal fraction was borrowed (or withdrawn from their savings) by other households and governments to fund their consumption. The third term (rΔD/Y’) represents interest payments over last year’s debt increase, due to delayed income of taxes and labour income. The fourth term (rϴD/Y’) represents the “net interest costs” of the existing debt, which equals the interest costs minus the fraction (1-ϴ)(r(D/Y’) that was recaptured by the public sector (taxes, labour, dividends). Disregarding defaults, the exact public budget constraint converges to an asymptotic level of debt relative to Y’ of (g+ϴ)/(g(1-r)-r ϴ(1-g)) if rϴ(1-g) is smaller than g(1-r), which is the case for realistic values of g, ϴ and r. We can rearrange the exact public budget constraint into the net public budget constraint (formula 5.37) by introducing the net interest rate (formula 5.36).

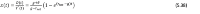

The continuous time differential equation that is the equivalent of the net public budget constraint (assuming a constant net interest rate) has the following solution with boundary condition x(t=0)=0 and x(t)=D(t)/Y’(t).

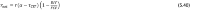

We can derive that if the net interest rate, the nominal growth rate, the profit margin, all tax rates, the dividend pay-out ratio and the savings rate are all constant, the net interest rate can be expressed as formula (5.40).

Here τCIT is the corporate income tax rate and DIV/FCF is the pay-out ratio (dividend divided by free cash flow). The formula states that the net interest rate equals the public interest rate multiplied by the fraction that is withdrawn from the real economy and added to the excess cash of the aggregated financial markets. The net interest rate equals all rental income minus all payments to governments (taxes) and households (all labour costs of and all net dividends paid by the financial sector). It also confirms that under realistic conditions the net interest rate is smaller than economic growth such that the public debt level of a closed economy converges to an asymptotic value. Nonetheless, we should not conclude that the financial system of such an economy would then be fundamentally stable. This is because the aggregated public debt is a summation of all debt of individual households and governments, some of which are diverging positively (negative debt levels) and some of which are diverging negatively that jointly add up to a converging aggregated public debt.

To see this please find below a simple example using realistic variables wherein aggregated government debt and aggregated household debt diverge in opposite directions such that the aggregated public debt converges from present day debt levels for a period of a hundred years.

Although at aggregated level the financial system seems stable (converging to 5 times GDP) it is in fact unstable because it inevitably results in defaulting households. So, in order to understand financial stability we need to distinguish between various types of governments and households.