Financial inequality

The net government budget constraint

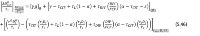

When decomposing the net public budget constraint, it can be shown that any governmental net budget constraint is expressed by formula (5.46).

Here, the grey connotations refer to the equivalent terms of the net public budget constraint. This formula tells us that for some governments maintaining a sustainable budget is much easier than it is for other governments. The main components that make sustainable tax regimes easy for governments are (1) a net trading surplus and (2) a large and international financial sector. For governments of countries with a small financial sector and a trading deficit it is virtually impossible to maintain prudent budgeting except by inflating debt away (printing money to stimulate inflation).

The net labour-income dependent households’ budget constraint

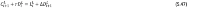

Imagine a group of all households in a closed economy that are fully dependent on income from labour and jointly spend a constant fraction cL of the total GDP (Yi) for any given year i such that their joint total consumption CLi= cLYi for any given year i. Let’s also assume that their joint annual net income LLi is annually adjusted for inflation and real growth such that LLi is a constant fraction αL of the GDP (Yi). This way the budget constraint of all the households that fully depend on income from labour in a closed economy is as follows:

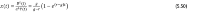

In words this means that the total consumption of the group of households that fully depend on labour income plus their joint interest payments must equal their income from the prior period plus the amount of new debt they need to borrow to fund the gap. The equivalent continuous time differential equation with x(0)=0 wherein x(t)=DL(t)/αLY(t) is the amount of debt of this group of households relative to their joint net income has the following solution:

Obviously, equation (5.50) disregards defaulting and holds true only for households that fully depend on income from labour and consistently fund nominal growth and interest obligations by borrowing money. Nonetheless it does reveal the main difference between households that fully depend on income and the rest of the public sector (households that own equity and governments). They are unexposed to financial income. Therefore, they have no feedback loop at all from their interest payments. Consequently, their net interest rate (rnet) equals the interest rate they pay for their loans. So in order to maintain a sustainable financial position, the interest rate they pay must be lower than nominal growth. And we all know that this is not the case. Even interest rates on mortgage-backed securities generally exceed nominal growth, let alone all other forms of consumer credit. Equation (5.50) captures the essence of debt-financed growth; it is not sustainable unless debt is for free without repayment obligations, which would make it a gift rather than a loan.

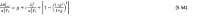

If wage increases lag nominal economic growth (which has been the case for most western economies in the past decades) the income-dependent households budget constraint is given by equation (5.54), wherein gL is the annual wage increase and αL0Yi is the total net income of these households in year i. The last terms on the right side between brackets express the ever-increasing additional funding requirement due to lagging wage increases.

Inflationary fractional reserve banking and inheritance are main drivers of instability

From the public budget constraint (5.25) we can see that there are two drivers in our current financial system that make the system fundamentally instable. Firstly, due to fractional reserve banking (money creation delegated to commercial banks by issuing loans) the creation of money to fund growth of public consumption is booked against new public debt (gY’i). This way, all real and inflationary growth of NDP (Y') creates an equal increase in public debt.

Secondly, since not all free cash flows are reused for consumption there is a drain of money (ϴY’i) out of the real economy into the financial markets. This amount is also booked against new public debt and hence further drives growth of public debt. Without central banking interference both drivers would inevitably result in deflation and negative nominal growth.

However, western central banks aim for nominal growth including inflation by stimulating borrowing (low interest rates) and injecting money into the financial markets (quantitative easing) instead of directly injecting money into the real economy where the money shortage occurs. Measures that in our view accelerate both the increase of public debt and the abundance of money in the financial markets. This can only end in negative interest rates and/or public defaults. The artificial growth of the financial sector driven by fractional reserve banking also yields to (1) a brain drain away from the real economy, which slows down real economic growth and (2) an ever-increasing amount of household savings and private sector excess cash, which inflates values of assets in the financial markets.

The third driver of instability in the financial system is low inheritance tax. Whereas debt is largely transferred publicly from generation to generation by government debt, equity and savings are largely inherited through bloodlines. Because return on capital is structurally higher than nominal growth (rcapital > g) it enables rich families to live from return on capital and still transfer more wealth to the next generation.