Aggregated time accounting and quality of life

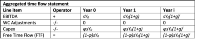

Please find below the aggregated time statements of a closed well-functioning economy for years 0 to years i denoted in units of useful time of the reference year 0 (present year).`

In the statements above φ is the investment rate, which is the fraction (percentage) of EBITDA (sYi) that is reinvested in creating future value.

We can now define the annual increase (or decrease) in quality of life in year i (accounted for based on historic costs) as the amount of labour investment in capital goods minus the depreciation of capital goods (s-δ0)Yi during the period i.

This equals NOPLATi = (s-δ0)Y0(1+g)^i which is the equivalent of the net profit of an unlevered company in financial accounting. The time dividend or free time flow DIVi =FTFi = (1-φ)sY0(1+g)^i is the share of the increase in quality of life that was spent on increased future leisure time. The remaining part (φs-δ0)Y0(1+g)^i is reinvested in increased future consumption which is accounted for by adding this to the equity reserves of the economy valued at historic costs.

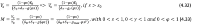

Formula (4.24) assumes that all productivity increases are reinvested in the economy (a self-financing process which implies φ equals 1). We did not take leisure time into account. Obviously, once people enjoy more leisure time (time dividend) this impacts the growth of future consumption. Therefore, we should account for this by including the fraction φ of available labour sYi that is used for creation of capital goods. If we adjust formula (4.24) we get formulas (4.32) and (4.33):